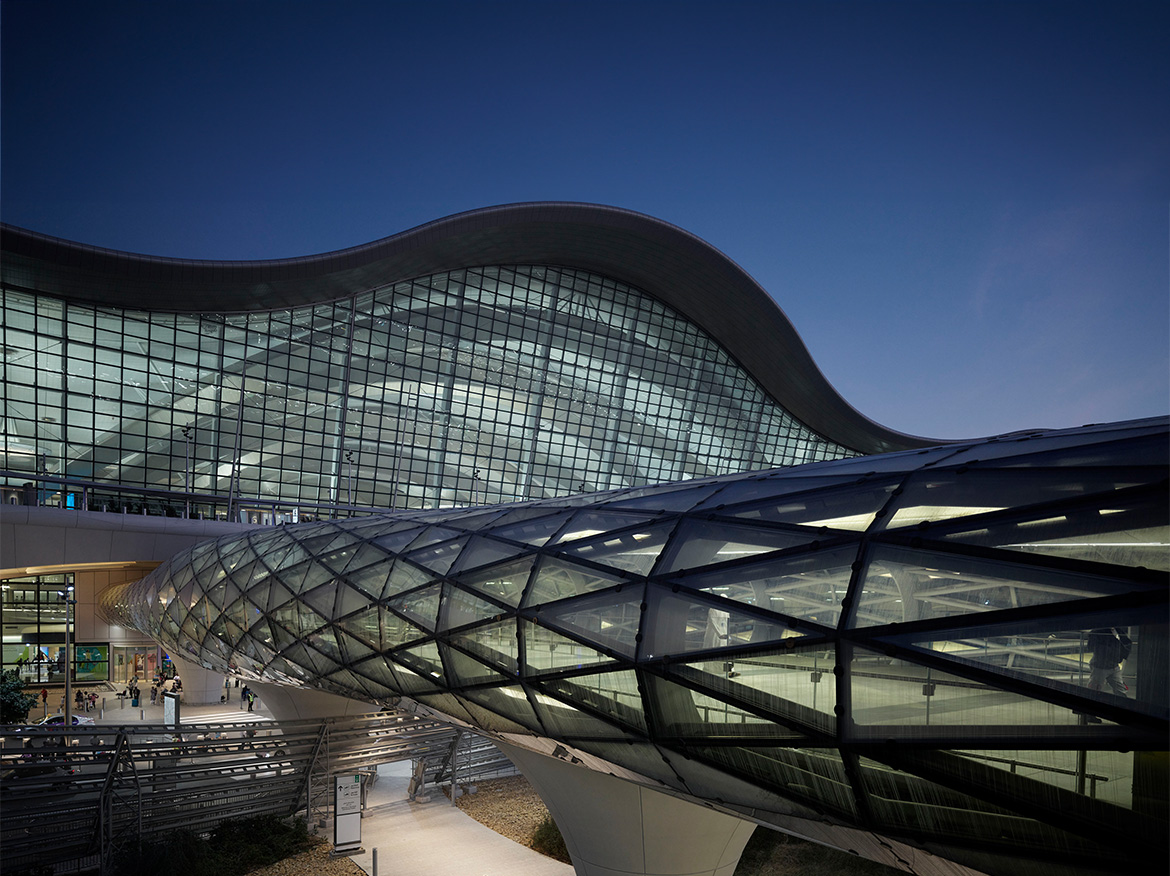

Abu Dhabi Innovations

Redefining air travel

Enjoy unparalleled technological advancements: biometric security, smart boarding gates, robot assistance, ensuring a new travel experience.

Things to know for a smooth trip

Departures

Departures Arrivals

Arrivals Transfers

TransfersAirport Services

Enhancing Your Airport Experience